TAXATION

The new Liberal government has proposed a few minor changes to personal income taxes for 2016 and beyond.

The election of a new government in Ottawa is often accompanied by changes to the way income is taxed. The last federal election was no exception. The changes announced in the March 2016 budget that will impact many taxpayers are as follows:

Family Tax Cut

Spousal income splitting was eliminated. In the past, one spouse or common-law partner could transfer as much as $50,000 of taxable income to the other to save up to $2,000 in income taxes. This option will no longer be available.

Child Tax Benefit

Taxpayers with children are familiar with the Canada Child Benefit (CCB) tax-free monthly payment and the taxable Universal Child Care Benefit (UCCB) that were designed to assist parents with the cost of raising children under the age of 18.

The new budget proposes that the CCB will provide as much as $6,400 per child under the age of six and $5,400 for children from six to 17. As can be expected, the benefits will not apply equally to all income categories. Levels of payout will be adjusted for those whose family income is between $30,000 and $65,000 and those who earn in excess of $65,000. If family income exceeds $200,000, there will be no benefits.

Indications are that the CCB will not be taxable and will not be included in certain federal income-test programs such as the Registered Disability Savings Program (RDSP). The new structure will be based upon the adjusted net family income for the 2015 tax year. Because the amount of the benefit will be tied to family income, benefits will be reduced as income rises.

Labour-Sponsored Venture Capital

Up to now, the federal government has permitted the creation of labour-sponsored venture capital corporations (LSVCCs) at both the federal and provincial levels. Prior to 2015, individuals purchasing $5,000 worth of shares in such corporations each year received a 15% federal tax credit. The credit was reduced to 10% in 2015. The federal government proposes to restore the credit to 15% for provincially registered LSVCCs for 2016 and thereafter but will reduce the credit to 5% for federally sponsored LSVCCs in 2016, then eliminate it. This is part of the federal government’s plan to close the federal part of the program altogether.

Education

Post-secondary

Individuals attending post-secondary educational institutions could previously claim tuition fees plus an education and textbook amount based upon the number of part-time or full-time months of attendance at a qualified institution. For 2016, the federal education and textbook amounts will be eliminated. The tuition fee amount will remain intact.

Teacher tax benefit

There are teachers and early childhood educators who may spend their own money on classroom supplies. To offset these out-of-pocket expenses, a new Teacher and Early Childhood Educator School Supply Tax Benefit will be introduced. A licensed and certified teacher can now purchase up to $1,000 worth of school supplies each year and receive a tax credit of 15% that should provide a tax savings of up to $150 each year.

Tax Free Savings Account

The tax free savings account will be reduced from $10,000 per annum to $5,500 for the 2016 tax year. In that the 2015 tax budget increased the former limit of $5,500 to $10,000, it is assumed the taxpayer will not be penalized for taking advantage of the $10,000 limit when tax planning in the start-up months before the March 2015 budget.

Home Buyers’ Plan

The Home Buyers’ Plan (HBP) allows first-time home buyers to withdraw up to $25,000 from their RRSP to purchase or build a home without having to pay tax on the withdrawal. The current plan required the amount to be repaid over a 15 year period. The government will now allow taxpayers faced with significant life changes (e.g., job relocation, death of a spouse, marital breakup or the requirement to house an elderly family member) to borrow from the RRSP without tax penalty.

Employer EI premiums are waived for young hires.

EI Break

The budget proposes to waive the Employment Insurance (EI) premium for 12 months for companies that hire individuals between the ages of 18 to 24 if they are hired into a permanent position in the years 2015 to 2018 inclusive. A minor reduction of the EI rate after the first year of hiring is contemplated as well.

Small Business

The previous government planned to reduce the small business tax rate from 11% in 2015 to 9% by 2019. The 2016 reduction to 10.5% is frozen with no further reductions planned.

67 to 65

The former Conservative government raised the age of eligibility to collect Old Age Security (OAS) from 65 to 67 starting in 2023. The new rules of the Liberal government will return the age of eligibility to 65. This age drop applies equally to the Guaranteed Income Supplement. Both programs will be adjusted to a new Seniors Price Index to reflect the actual rising cost of goods and services.

Personal Tax

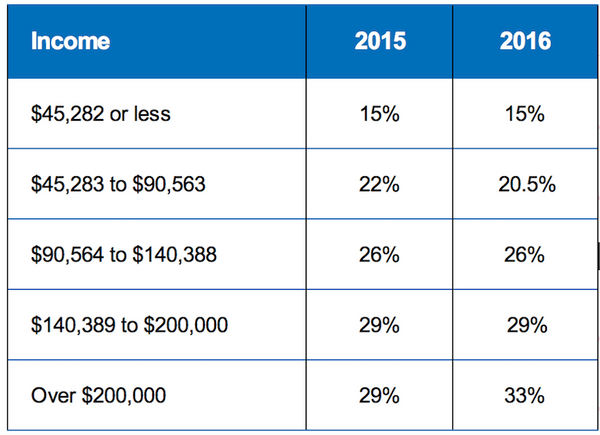

Tax cuts are always welcome. If all goes as planned, middle income individuals (i.e., those earning between $45,283 and $90,563 per annum) will have their tax bracket lowered. This table provides the tax bracket as well as a comparison of 2015 and anticipated 2016 federal tax rates.

Automobiles

The automobile allowance rate for the 2016 taxation year is 54 cents per kilometre for the first 5,000 kilometres driven, and 48 cents per kilometre after that. Add four cents per kilometre in the Northwest Territories, Yukon, and Nunavut. This is a reduction of one cent per kilometre.

The following amounts are unchanged:

- capital cost for vehicles: $30,000 plus applicable taxes

- leasing rate for vehicles: $800 per month plus applicable taxes

- monthly interest deduction: $300 per month

- taxable benefits associated with employer-owned or employer-leased vehicle available to employees.

The personal portion of automobile operating expenses paid by employers for 2016 is reduced from 27 to 26 cents/kilometre. If the taxpayer is selling or leasing vehicles as a mainstay of employment, the rate will be reduced to 23 cents/kilometre. These personal portions are taxable.

Little Changed in 2016

Changes to the tax system for individuals will not have a significant impact on the take-home pay for the average taxpayer and will not, for most, change the information required for preparation of the 2016 personal income tax returns.

Contact Argento CPA today!

Source: BUSINESS MATTERS

Disclaimer: BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.

Richard Fulcher, CPA, CA – Author; Patricia Adamson, M.A., M.I.St. – CPA Canada Editor.

Contact us: patricia@adamsonwriters.ca