TAXATION

Be aware of the changes that affect your 2016 income tax filing and beyond.

As you gather your 2016 tax data together for your CPA, take a few moments to read about the following changes and assess the impact they may have on you and your family’s filing for 2016 and after.

Principal Residence

There has been a significant change in the CRA’s policies regarding principal residency that must be followed by all taxpayers. Prior to 2016, there was a requirement to fill out form T2091 to designate your home as a principal residence. The form required you to designate the years in which the home was your principal residence. Although this form was required to be filed in the year of disposition, most individuals never filed the form because the resulting capital gain was often fully eliminated by claiming the principal residence exemption. Administratively, the CRA had waived this requirement to file if the exemption eliminated the gain.

Significant Rule Changes

For the taxation years that end on or after October 3, 2016 (e.g., the 2016 calendar year), if you sell your principal residence, you are required to report the sale and the resulting capital gain or loss on Schedule 3 of your T1. You are also required to file the form T2091 if you are claiming the principal residence exemption. These requirements are imposed regardless of whether or not the gain is fully exempt as a result of the designation.

A failure to file and disclose the information will have serious implications. Firstly, there is no limitation period (i.e., after which your returns are considered “statute-barred”) on the CRA’s ability to reassess in the future. Therefore, the deadline which would otherwise restrict the CRA’s ability to re-open the tax return would not start unless the information had been fully disclosed in the year of disposition.

Secondly, the principal residence exemption itself will only be allowed if the sale and the designation of principal residence are reported on your income tax return. Should you realize subsequent to the year of sale and filing of your income tax return that you did not file the sale of your principal residence, the CRA is not obligated to accept a late filing that designates the sale as a principal residence sale. Even if the CRA accepts the late filing, the taxpayer will be liable for penalties that are the lesser of $8,000 or $100 for each complete month from the original filing due date to the date the required information was received by the CRA in an acceptable format.

Since these rules will be effective for the 2016 calendar year, you should remember to report the sale of your principal residence if you had a disposition during the year.

Basic Personal Amount

The Federal Basic Personal Amount will increase to $11,474 for 2016, up from $11,327 in 2015. For 2017, the amount will be $11,635.

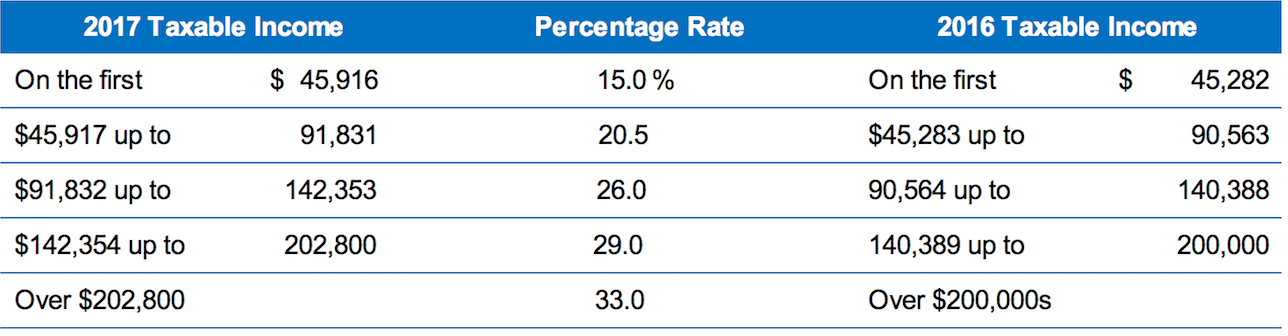

Marginal rates remain the same in 2017.

Marginal Rates

There have been no changes in the overall federal marginal tax rates; however, the thresholds for taxable income have been changed as indicated in the comparison table below. Keep in mind that these rates do not include the provincial rate nor do they include the various credits and deductions that may reduce the overall income tax for which you may be liable.

Other Changes

The 15% children’s fitness and arts tax credit, as well as the education and textbook tax credit, will be eliminated effective January 1, 2017. For 2016, the maximum Children’s Fitness and Arts tax credit will be 50% of the previous allowable amounts. Unused textbook and education tax credits from previous years may be carried forward and applied to reduce future taxable income.

- Teachers and early childhood educators will be able to purchase up to $1,000 of eligible school supplies for use in the classroom. From January 1, 2016, a 15% tax credit will be available on those purchases. For instance, if $500 is spent, a tax credit of $75 would become available to reduce taxable income. Teachers and early childhood educators should familiarize themselves with the allowable expenses and prepare a summary supported by the original receipts to assist in meeting Canada Revenue Agency’s guidelines.

- Prior to January 1, 2016, if a couple was supporting a child under the age of 18, the couple was able to split income to reduce the overall family tax liability. Effective January 1, 2016, income splitting is no longer available.

- Northern residents will have their residency deduction increased for the 2016 taxation year. The northern residency deduction will increase from $8.25 to $11 per day (or from $16.50 to $22 per day for living in a self-maintained dwelling) if you lived in Zone A for at least six consecutive months. If you lived in Zone B, the intermediate area, the deduction will increase from $4.125 to $5.50. ($8.25 to $11 per day for living in a self-maintained dwelling). The zone for deductions is determined on a province-by-province basis. Thus, to ensure the appropriate tax deductions are available to you, consult the CRA website, click on your province’s name, and search for your place of residence. Make sure your CPA is aware you resided in a zone that provided deductions for line 255 of the tax return.

Check with Your CPA for the Required Documents

There have been changes in personal tax issues in the 2016 year, but none are as important as the principal residence rules. If you have sold your principal residence in 2016, contact your CPA to find out what documentation is required to ensure you are meeting the CRA reporting requirements.

Contact Argento CPA today!

Source: BUSINESS MATTERS

Disclaimer: BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.

Richard Fulcher, CPA, CA – Author; Patricia Adamson, M.A., M.I.St. – CPA Canada Editor.

Contact us: patricia@adamsonwriters.ca