Most founders think of expenses as either “good” or “bad.”

But not all spending is created equal.

Some costs keep your business running — things like payroll, rent, and software.

Other costs build the future — investments in new products, services, or marketing that expand your capacity or market share.

Greg Crabtree calls these investments Launch Capital in his book Simple Numbers 2.0.

And understanding the difference between core capital and launch capital is one of the most important financial distinctions a growth-minded CEO can make.

1. The Four Kinds of Business Capital

Crabtree outlines four types of capital every business needs to manage:

- Trade Capital – What keeps daily operations moving: receivables, payables, and inventory.

- Infrastructure Capital – Your tools, systems, and equipment.

- Buffer Capital – Your safety net; working capital to weather volatility.

- Launch Capital – Money invested for future growth.

Launch capital is the most misunderstood. It’s not about maintaining the business — it’s about creating the next version of it.

2. What Counts as Launch Capital

Launch capital covers non-routine spending designed to generate future revenue or improve profit capacity. Examples include:

- Building a new product or service line

- Entering a new market or geography

- Increasing marketing to accelerate growth

- Hiring ahead of demand for strategic capacity

- Implementing a new system or platform that improves scalability

It’s not maintenance. It’s momentum.

The key question is:

“Will this investment meaningfully increase future gross profit or efficiency?”

If the answer is yes — it’s launch capital.

If it simply maintains current performance — it’s core expense.

3. Why Classifying Launch Capital Matters

When you mix launch capital with regular expenses, you lose visibility.

Your financials start to look worse than they are because growth investments get buried under “overhead.”

By tagging and tracking launch capital separately, you can:

- See which initiatives actually produce a return

- Avoid overreacting to short-term profit dips

- Make future investment decisions based on data, not emotion

In other words, you transform spending into strategy.

4. How to Separate Launch Capital in Your Financials

Here’s how we help clients do it:

- Tag any non-recurring, growth-oriented expense— for example, “Marketing Campaign – Launch Capital” or “System Implementation – Launch Capital.”

- Tags allow you to view specific reports that will separate launch capital from regular spending. This allows you to measure an ROI on the additional revenue and profits generated from that spending.

- At month-end/quarter/year, calculate ROI on launch capital separately from your regular profit analysis.

This gives you two clear pictures:

- How efficient your core operations are, and

- How effective your growth investments are.

5. What Return Should You Expect

Crabtree’s benchmark is simple:

A minimum 50% annual return on launch capital.

If you invest $100,000, you should expect at least $150,000 in incremental pre-tax profit — your original investment plus $50,000 profit — within a reasonable timeframe (typically 12–18 months).

This ensures you’re compounding capital efficiently rather than just spending it.

For lighter-capital businesses (like agencies), the bar can be higher — 75–100%+ ROIC is achievable because the incremental cost of scaling delivery is low compared to capital intensive businesses like manufacturing.

6. The $1 That Costs $6

Here’s why this matters for valuation:

If your business generates $3M in EBITDA and sells for a 6× multiple, it’s worth $18M.

Now imagine you overspend $500,000 without return.

That expense doesn’t just cost you $500k — it wiped $3M off your enterprise value.

Every wasted $1 of expense destroys roughly $6 of business value.

But the reverse is also true: every dollar of efficient investment can create six more in value.

That’s the power of disciplined launch capital deployment.

7. How to Build Launch Capital Into Your Forecast

When we build forecasts for clients, we analyze launch capital.

For example:

| Category | % of Revenue | Notes |

| COGS | 30% | Delivery and fulfillment |

| Overhead (Core) | 40% | S&M, Admin, OPEX |

| Launch Capital | Variable (5–10%) | Growth investments |

| Profit | 20–25% | Target pre-tax |

The rule:

- Never let launch capital exceed 10% of revenue unless you’ve modeled the ROI.

- Once you’ve earned back the return, fold it into your normal forecast baseline.

- If the ROI doesn’t materialize, cut fast — don’t “double down” emotionally on sunk costs.

This way, your forecast acts as both guardrail and growth engine.

8. Measuring ROI on Launch Capital

To treat launch capital like a real investment, you need to measure it like one.

Here’s the simple framework:

- Define the spend. (What are we investing in?)

- State the goal. (What new revenue or margin are we targeting?)

- Forecast the return. (When will we see results?)

- Track actual results monthly.

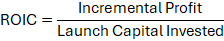

- Calculate ROIC:

If the return is below 50%, re-evaluate the strategy.

If it exceeds it — double down strategically.

Example:

You spend $120,000 launching a new marketing campaign.

Over 12 months, you generate $200,000 in additional gross profit.

ROIC = $200,000 ÷ $120,000 = 166%

That’s capital well deployed.

9. How Launch Capital Fits Into Value Creation

When buyers evaluate your company, they look for predictable, recurring profit and evidence of efficient capital use.

Properly tracking launch capital helps you:

- Explain margin dips (“We invested $200k in Q3 to build a new service line that’s now profitable.”)

- Demonstrate ROI discipline — proof that you only invest where results justify it.

- Build buyer confidence in your financial maturity and decision-making.

Buyers pay higher multiples for companies that understand and control their capital deployment.

10. The Behavioral Shift: Treat Spending Like Investing

At Argento CPA, we teach clients to adopt one mindset:

Every expense is either an investment or a liability.

Launch capital isn’t random spending — it’s a planned investment that must prove its worth.

That means:

- You don’t “try” marketing campaigns — you invest in them with a required return.

- You don’t “hope” new hires work out — you model their productivity and profit impact.

- You don’t “experiment” with new tools — you pilot them with a defined metric for success.

That’s what separates strategic operators from reactive ones.

11. Launch Capital in Practice: A Quick Example

Let’s use an agency example.

You decide to spend $100,000 building a new content service line.

That includes one new hire, marketing collateral, and training.

Within six months, it adds $25,000/month in gross profit — $300,000 annualized.

Your $100,000 investment produced a $200,000 return in the first year — a 200% ROIC.

That’s how wealth is built — through intentional capital deployment.

12. Final Thought

The difference between great operators and average ones isn’t how much they spend — it’s how intelligently they invest.

Launch capital is your growth fuel.

Used strategically, it compounds returns, builds enterprise value, and accelerates freedom.

Used recklessly, it destroys margin and creates chaos.

So the next time you spend money, ask one question:

“Is this maintenance — or momentum?”

If it’s momentum, measure it. Track it. Expect a return.

Because profit isn’t an accident — it’s the outcome of disciplined capital allocation.

About Argento CPA

Argento CPA partners exclusively with high-performing marketing agencies that want clarity, strategy, and profitability — not just compliance.

We specialize in fractional CFO services, financial strategy, and profit improvement systems that help agencies link performance with profit.

Our team helps agencies:

- Track and improve LER by department and role

- Build training and incentive systems tied to profitability

- Design bonus plans linked to financial performance

- Establish feedback and reporting rhythms that sustain growth

- Align personal development with agency financial goals

Our approach is practical, fast, and collaborative — built for agency founders who want to scale sustainably with a high-performance team.